Aug 12, 2024 in Financial Planning, Wealth Management

Procrastinating Retirement Planning

By Julia Png, Senior Client Services Associate, Javelin Wealth Management

Retirement Planning? The longer you wait, the more painful it’ll be.

As a chronic procrastinator myself, I can attest to the fleeting satisfaction of finishing a task just in time. That said, during my time assisting clients with their financial goals, I’ve learnt one key lesson: Procrastination today brings financial struggle tomorrow.

Do I need to stress the importance of early retirement planning? There are plenty of resources that explain why starting early is crucial. By delaying, many miss out on the benefits of compounding, often referred to as the “eighth wonder of the world.” If you are unfamiliar with this concept, I encourage you to check out this comprehensive article from my colleague “Simple Wealth #1 Compounding”.

Despite having an abundance of resources for financial planning, we frequently encounter individuals seeking advice just a few years before their desired retirement age, and even those who are in their 60s.

Many younger individuals justify postponing retirement planning by focusing on more immediate priorities – purchasing their first home, saving for their children’s education, or planning dream vacations. Once they achieve their goals, they realise that the golden period for effective retirement planning has closed.

In truth, managing your bucket list and planning for retirement can and should be done simultaneously. These aspirations should be part of a unified ‘life plan,’ or what we call a Wealth Journey. By setting and aligning your financial goals, you can effectively allocate resources to achieve both short-term dreams and long-term retirement security.

So, what is retirement planning, and why is it so challenging to start?

At its essence, retirement planning involves determining your ideal retirement age and estimating your future expenses. However, these tasks are often more complex than they appear.

Hope is not a strategy

Most people envision retiring as early as possible and spending as much as they can afford. While this may sound straightforward, the reality is much more complex. There are numerous variables to consider, making it challenging to set realistic goals. This complexity often leads people to adopt a “just see how it goes” approach and delay their planning.

Beyond defining your retirement goals, it’s crucial to focus on specifics.

How much time do you have left?

How much do you need to save?

What growth rate can you expect for your investments?

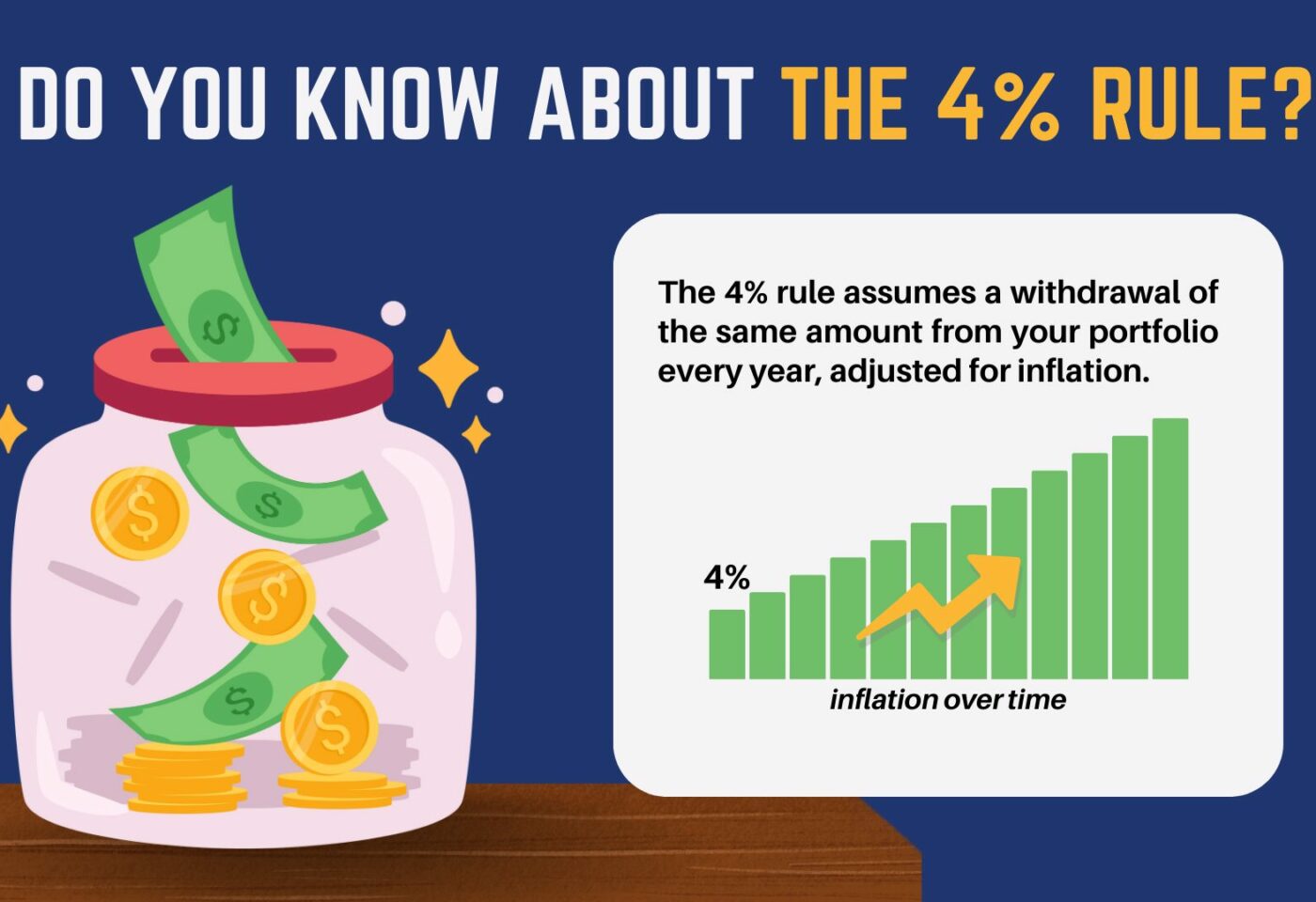

The 4% Rule

This measure is a rule-of-thumb approach which helps calculate retirement spending. It simulates a steady and reliable income stream for at least 30 years, provided that your investments continue to yield a similar rate of return.

For example:

If you have $1 million in total retirement savings, you will have a budget of $40,000 in your first year of retirement.

For the second year of retirement, you would multiply that $40,000 by the rate of inflation assumed to be 3%. Hence, your retirement budget for the second year would be: $40,000 x 1.03 = $41,200. Repeat this step every year, you would be able sustain this budget for at least 30 years.

Even if you think it’s too late, it’s better late than never.

Recently, one of our peers proudly shared that he had accumulated a sizable savings account over the past decade through consistent investing. Envious, another friend lamented that it was too late for him to start saving, fearing he would be too old to see significant benefits in ten years. What he didn’t recognize was that failing to start saving now meant he would still be in the same position a decade from now.

In practice, retirement planning is a dynamic process that varies according to an individual’s specific needs and goals. Once you establish a basic framework for your retirement plan, the next step is to craft a strategy and execute it.

Regular reviews are essential for tracking your progress and making necessary adjustments. The key is discipline, stay committed to the planning process and ensure consistent progress reviews. Time to put it on the calendar!

Take the first step towards retirement planning and if you’re feeling uncertain or overwhelmed… Explore our Wealth Training Workshops where we help you understand and implement effective retirement strategies. Don’t be a procrastinator!