There’s a big gap between what most financial firms say, and what they actually do. Their words speak louder than their actions. In reality, short-term revenues are more important to them than long-term relationships with clients.

We set up Javelin Wealth Management in 2003 to provide something we couldn’t find for ourselves: straightforward advice for a simple fee and a focus on long-term wealth management.

To help you through your investment journey, we’ve come up with 11 questions for you to ask yourself and any financial company you work with - including us.

They’ll help you understand what you should be looking out for and gauge whether they’d work for you.

We make recommendations only after you’ve told us what you’re looking for.

We only recommend products that we would invest in ourselves.

We work for you, not for a commission.

We own our business. Its continued success is down to always putting our clients first.

With us, you get a team and not just an account manager. No matter who you work with at Javelin, our advice is the same but is driven by your needs. We work for you.

After listening to what you need, and after creating a plan to get there, we take pride in personally guiding you through every stage of your financial journey. This ensures you get continued peace of mind from our comprehensive service; one which is focused on your wealth and on your future needs.

We are proud of the fact that our single fee is simple and transparent. We agree this fee with you at the outset and stick to it, as you can see from your monthly statement. There are no additional fees, upfront charges, penalties, commissions or kickbacks. This unique transparency clearly aligns our interests with yours. Always. That’s the way it should be.

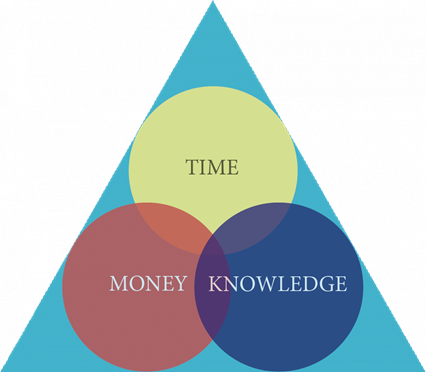

It takes time to understand your investment needs and objectives. If you are willing to put in the time and effort, then you can and should manage your own money.

However, it’s more than likely that the majority of people will prefer to prioritise other things and to spend their time doing something else – with their family, with their business or in pursuing personal interests.

If you think that this describes you, then it’s likely you will be short of the time you really need to spend in determining your financial “present”. It’s only once you have done this, that you can begin to work on planning for your financial “future”; and what you will need to do in order to get there.

If you tell us your story, we’ll give you your time back.

T: +65 6557 7185

F: +65 6423 1164

E: enquiries@javelinwealth.com

A: 144 Robinson Road #16-01 Singapore 068908

Founder and Chief Executive Officer

Steve first arrived in Singapore to work in 1987. Steve worked as a stockbroker and senior director of ABN Amro’s Asian equity business for 13 years, during which he participated in a successful management buy-out. He holds Masters degrees from London Business School and Edinburgh University, and is a former EXCO member and Treasurer of the Financial Planning Association of Singapore, and is an IBF Advanced (IBFA) certificate holder from the Singapore Institute of Banking and Finance. Steve is also a Certified Financial Planner (CFP®), and a qualified Associate Estate Planner (AEPP), and holds a Certificate for Financial Services – Trusts and Estate Planning.

Partner

Polka has over a decade’s experience in Financial Services. She has worked as a Mergers & Acquisitions and Private Equity syndication specialist across Asia with a diverse sector focus. Polka started her career with the Australia and New Zealand Banking Group and then moved to the Investment Banking team of Avendus Capital. She moved to Singapore in 2010 with Daiwa Capital Markets. She holds a Bachelor of Technology from the Indian Institute of Technology and Post Graduate Program in Management from the Indian School of Business.

Senior Adviser

Peter is a passionate Kiwi that has been in Singapore since 2002. After 20 years of professional financial markets trading experience with major banks, Peter switched careers in 2012 to wealth planning to impart the knowledge and life experience gained to those who truly value that support.

With an unique mix of multi-jurisdiction hands-on private business and real asset directorship experience, Peter helps clients to deeply understand the planning process and provides advice that is truly independent of financial service product providers. Peter holds a Bachelor of Commerce (Economics and Marketing) from Lincoln University and Master of Business Administration from Otago University, New Zealand.

Macro and Equities

Gary Dugan has been a high-profile investment professional in Europe, Middle East and Asia for the past 38 years.

Gary has held key positions, including Chief Investment Officer, with major institutions including Barclays, Merrill Lynch and two of the largest banks in UAE. He has also been adviser to OECD, the European Parliament and leading sovereign wealth funds.

In 2018, Gary was appointed the CEO of Purple Asset Management. He subsequently founded and launched an outsourced CIO services business – The Global CIO Office.

Fixed Income Consultant

Simon started in the Finance Industry in 1986. He has worked in the World’s major centres for Companies such as SG Warburg, UBS and ABN Amro, as a trader and a manager of teams in the Fixed Income space. He spent 8 years in Japan and has lived in Singapore since 2001. Whilst he has a broad Fixed Income background, his main focus since 1997 has been the Asian Corporate Bond markets both offshore and local currency and he has managed risk and businesses across both. He has been a Registered Representative in London, Tokyo, Hong Kong, New York and Singapore. He has a B.A Jt. Hons from Leeds University.